Aluminium

Why Aluminium Needs a New Layer of Price Discovery in 2026

Published on

Share Post

Aluminium

Written bySamir Jaber

Published on

Share Post

Index

Who this is for: Procurement leaders, sourcing managers, traders and commercial teams active in primary aluminium, billets, wire rods and other value-added products.

Aluminium sits at the centre of several global shifts, from rising industrial demand to energy-driven supply constraints, new trade barriers, and increasingly regionalised material flows. It is a market defined by a strong global benchmark, the LME price. Yet procurement teams face rising uncertainty when securing physical metal. The reason is that the benchmark only captures one part of the price. The physical market determines the rest in the form of a premium for physical delivery.

Regional supply/demand dynamics, brand premiums (including P1020 premiums, billet premiums, and other brand-related differentials), freight differentials, warehouse queues, and sustainability attributes drive the level of physical premiums. These variables are becoming increasingly volatile and challenging to monitor in real time. This is driving a renewed focus on price discovery, even in one of the most established metals markets. It is also creating a clear role for digital platforms that capture market signals directly from buyers and sellers.

Aluminium has long been anchored by the LME benchmark, which provides a stable reference for producers, traders and industrial consumers. It supports hedging strategies and underpins long-term planning. While the benchmark remains a critical price signal, it captures only a part of the dynamics shaping the physical aluminium market today. Physical premiums now influence the real cost of material far more than in previous market cycles.

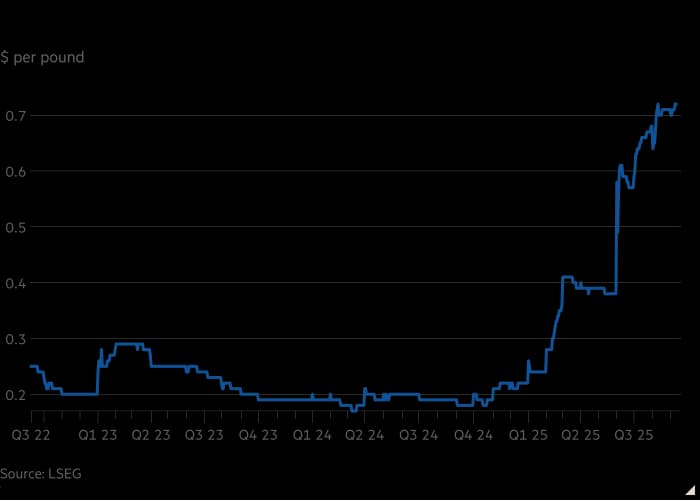

In the United States, the Midwest premium has surged by more than 170% this year and is at its highest level in more than a decade. European premiums have also increased, as trade routes shift and regional supply tightens. These movements reflect local conditions, such as defensive stockpiling ahead of new tariffs, logistics constraints, and regional imbalances, rather than changes in the global benchmark.

This distinction is vital. Historically, physical premiums often moved in tandem with the LME price. In 2025, however, we have seen periods where the correlation dropped significantly—in some quarters even turning negative. This statistical divergence suggests that while the global exchange price is functioning as it should—reflecting global macro-fundamentals—the physical premium has taken on a life of its own, driven by hyper-local constraints.

Credit: Financial Times

Market tightness is also becoming structural. Inventories across major warehouse systems have dropped to around half of last year’s levels. Fresh waves of cancelled warrants indicate that more metal is being withdrawn from the system, tightening near-term availability. These developments reflect a market where access to physical tonnes can shift quickly, pushing the cash-to-three-month spread into backwardation and signalling immediate supply stress.

Several forces sit behind this shift. China, which produces nearly 60% of the world’s primary aluminium, continues to operate under a national production cap that restricts output, and recent drought-related pressure on hydropower in key provinces has highlighted how exposed its capacity is to weather and energy conditions.

Furthermore, the energy crisis in the West has mutated into a structural competition for power. Smelters in Europe and the US are no longer just fighting high gas prices; they are losing long-term electricity contracts to AI data centres. As noted in recent 2026 outlooks, while smelters need power at around $40/MWh to remain competitive, tech giants are locking in contracts above $115/MWh. This effectively strands millions of tonnes of capacity offline.

Producers in regions such as Indonesia and India are attempting to fill this gap, but they have been slow to bring new capacity to market due to infrastructure constraints and policy uncertainty. At the same time, demand from the automotive, packaging, and construction sectors has remained resilient.

Consequently, analysts expect the surplus seen in recent years to move into a deficit of between 200,000 and 600,000 tonnes by 2026, ensuring that upward pressure on prices remains a permanent feature of the market.

The result is a market where the LME price remains essential but cannot serve as the sole indicator of physical delivery costs. Brand premiums, freight differentials, delivery terms, tariffs, quality characteristics and sustainability attributes now determine the actual price procurement teams pay. In a more volatile and regionally fragmented market, understanding these variables has become critical. Clear, real-time price discovery is, therefore, increasingly important for companies seeking cost transparency and commercial certainty.

Credit: Financial Times

Price discovery matters because procurement outcomes are driven by the spread between the benchmark and the real transaction environment. That spread grows when markets tighten, when trade flows shift or when alternative materials influence regional availability. The benchmark provides direction, yet it does not reveal the competitive tension that determines what buyers pay or what sellers achieve in practice.

This opacity has winners and losers. It is no coincidence that major commodity trading houses have reported robust profits in their metals divisions throughout 2024 and 2025. Their executives openly describe this volatility as a “margin opportunity.” For a trader, an opaque premium spread is a profit engine. For a procurement team, it is a budget leak. If you cannot see the real-time bid/offer spread on the premium, you are effectively subsidising the arbitrage of those who can.

It also matters because new pricing variables are emerging with hard deadlines attached. With the Carbon Border Adjustment Mechanism (CBAM) financial obligations commencing on January 1, 2026, the carbon footprint of a specific batch is no longer just a “sustainability attribute.” It becomes a direct component of the landed cost. These attributes introduce new premiums and discounts that are not visible through traditional references but will fundamentally alter the competitiveness of imported material.

In recent bilateral deals, we are seeing low-carbon aluminium (under 4t CO2/t Al) trading at significant premiums over standard P1020; yet, this “Green Premium” remains invisible in most standard indices. With CBAM audits looming, a buyer who doesn’t know the specific carbon-adjusted market price is negotiating blind.

Furthermore, major European producers and associations have publicly called for CBAM suspensions earlier this month, citing the threat to competitiveness. When the rules of the game are being challenged just weeks before the deadline, commercial certainty evaporates. In this regulatory fog, a digital platform that binds the specific carbon data to the transaction provides an auditable foundation in a complex market environment.

Secondary material dynamics create another layer of price formation. Scrap that is remelted and reintroduced into the market often follows different pricing patterns from primary metal. As noted in a July 2025 market analysis by Discovery Alert, while primary prices weakened due to macro-headwinds, secondary markets demonstrated “limited willingness to adjust prices downward despite the bearish signals from primary aluminium.”

Traders adopted a ‘wait-and-see’ attitude, which kept physical prices elevated even as the exchange price declined. This decoupling is about to accelerate due to policy intervention. With the EU Commission signalling plans to restrict aluminium scrap exports by Spring 2026 to prevent ‘leakage,’ the correlation between European scrap and global LME prices will weaken further. Regional availability will be dictated by these trade barriers, not global exchange stocks.

Furthermore, energy markets remain a major determinant of supply. Aluminium production is highly energy-intensive, and smelter curtailments can remove meaningful tonnage with limited notice. Shutdowns in Europe have demonstrated how quickly this can reshape regional availability.

Aluminium, therefore, requires a form of price discovery that reflects real market behaviour. Procurement and sales teams need visibility into how prices form across regions, counterparties and specifications. They need market signals that reflect current conditions, rather than historical averages or formula-based pricing.

Clear, transaction-linked price discovery built through spot markets and transparent contracts supports more informed decisions in a market where pricing structures are becoming more complex and commercially significant. This complexity exposes a structural information gap that traditional pricing channels cannot fully close.

Aluminium pricing remains dispersed across multiple channels. Buyers monitor PRA assessments, bilateral negotiations, premium indications, freight movements and warehouse data, each of which reflects only part of the market. In a volatile 2025 market, a weekly assessment based on reported deals serves as a rearview mirror. Procurement and Sales teams need a transparent windshield to see what is happening now.

This fragmentation becomes most visible when markets move quickly:

Furthermore, recent tariff shifts and logistics shocks have exposed this vulnerability. While headline premium assessments were slowly climbing, procurement teams on the ground were already facing significantly higher supplier offers. This is a massive disconnect.

The latest developments in the US Midwest premium market have shown that when pricing information becomes more transparent and based on named bids and offers, market participants gain clearer signals and uncertainty decreases. The principle is universal: markets function more effectively when real trading activity is visible and actionable.

These gaps create uncertainty at the moment decisions need to be made. Buyers hesitate to commit without clarity on likely landed costs. Sellers face difficulty positioning offers competitively while protecting margins. Negotiations become slower, and risk increases for both sides. Aluminium now requires price discovery that reflects the commercial conditions unfolding across regions, products and counterparties.

Metalshub helps close this gap by enabling price discovery based on real market activity. The platform captures commercial signals directly from verified buyers and suppliers rather than relying on delayed or indirect references.

Participants submit structured offers that include full commercial terms, such as premiums, discounts, delivery points, logistics, timing, and specifications. This structured approach is designed to accommodate the full spectrum of products, including Value-Added Products (VAPs), such as billets and wire rods. By digitising these complex specifications, the platform provides a pathway to transparency in segments where premiums often move independently of the traded exchange market.

Procurement teams can compare offers transparently, understand regional variations and quantify the impact of freight and specification differences. Suppliers gain insight into demand levels and how their pricing aligns with market expectations.

As more transactions take place through the platform, the quality and relevance of market signals strengthen. The data generated reflects true buyer willingness to pay and true seller willingness to supply. This produces a more accurate view of price formation than premiums reported by the PRAs or bilateral negotiations alone.

Metalshub does not replace the benchmark. It enriches it by revealing the market behaviour that surrounds it, creating a clearer foundation for procurement decisions in a complex and fast-moving aluminium landscape.

Price discovery in Metalshub

Clear price discovery strengthens both sides of the aluminium market.

For procurement teams, transparent market signals translate directly into better commercial outcomes. When buyers understand how prices are forming across regions, specifications and delivery windows, they plan more accurately and negotiate with greater confidence. They gain clarity on competitive market levels, prepare tenders with stronger internal justification and manage exposure more effectively during periods of volatility. This supports more consistent decision-making and raises the quality of governance across the sourcing process.

Suppliers benefit in equal measure. Visibility into buyer interest and pricing expectations helps commercial teams position their offers with precision. Structured digital tenders provide an efficient way to market excess volumes, reach new counterparties and build a clearer picture of regional demand conditions. The result is improved alignment between supply and demand and a more transparent route to competitive deal-making.

When both sides operate with clearer information, the market functions with greater efficiency. Prices reflect real conditions. Negotiations move faster. Commercial outcomes improve. This is the practical value of stronger price discovery in aluminium. In a market defined by structural change, transparent price discovery will shape the next era of commercial performance in aluminium.

Newsletter