Aluminium

Industrial Minerals

Alumina Price Discovery: The Case for a Reliable Global Index

Published on

Share Post

Aluminium

Industrial Minerals

Written bySamir Jaber

Published on

Share Post

Index

The Alumina market still lacks a truly reliable global price benchmark, creating persistent uncertainty for producers, traders, and smelters. As digital marketplaces like Metalshub begin facilitating alumina transactions, the industry is exploring whether platforms can finally strengthen price discovery where traditional benchmarks struggle.

Alumina remains one of the largest industrial commodities without a truly reliable global price benchmark. Unlike primary aluminium, which benefits from relatively transparent exchange trading, alumina pricing is still shaped largely by private bilateral contracts and internal transfers. This leaves only a thin spot market to inform price signals. As a result, published indices from price reporting agencies (PRAs) often rely on limited transaction data or surveys and often fail to capture ‘true’ market value.

Recent volatility has exposed these structural weaknesses. In late 2024, alumina spot prices surged above $780 per tonne following supply disruptions, far outpacing aluminium. By 2025, refinery restarts, surplus expectations, and falling bauxite costs drove prices back toward the mid-$300s per tonne, roughly half the peak. The speed of this swing highlights how limited liquidity, cost-driven pricing, and opaque contracting amplify volatility in the alumina market.

Credit: S&P Global

Global trade in smelter-grade alumina exceeds 100 million tonnes annually, but a large share of it never reaches the open market. Much of alumina is produced by vertically integrated companies (i.e., aluminium producers who own their own refineries or have joint ventures). It is transferred internally or sold under multi-year contracts rather than on a spot basis.

Even independent refiners typically secure long-term supply contracts with smelters. For smelters, security of supply is very important because a stoppage due to a lack of alumina feedstock would be incredibly expensive. As a result, the truly spot-traded volume of alumina is relatively small. A Fastmarkets 2021 report estimated the freely tradeable alumina spot market at only about 30 million tonnes per year, while the remaining is still tied up in long-term deals.

There may be only a handful of spot cargoes traded in a given week; sometimes none at all in quieter periods. This means each deal (or even non-binding bid or offer) that does occur can have an outsized influence on reported prices. Traders back in 2018 remarked that a single alumina cargo deal could move the market price by $200/tonne because of how scarce and critical each data point was.

Seaborne alumina supply is heavily concentrated, with Australia accounting for the majority of global exports. As a result, the FOB Australia price has emerged as the de facto reference point for much of the market.

However, demand centres across China, the Middle East, Europe, and the Atlantic basin face different freight costs, quality requirements, and local supply conditions. These differences create persistent regional premiums and discounts.

For instance, Brazilian alumina often commands a premium over Australian material because the freight costs to Atlantic basin smelters are lower. In August 2025, Brazilian FOB alumina was about $28/mt higher than Australian FOB alumina. Other origins, like India or Indonesia, might trade at $5–$10 premiums over the Australian FOB index in the same period. This means there are interconnected regional markets with basis differentials that must be accounted for.

In the absence of an exchange-traded price, the alumina industry has turned to price reporting agencies (PRAs) to fill the gap. PRAs aim to turn a thin, opaque market into a usable reference price by collecting real-world inputs from market participants and aggregating them into an index price.

At a high level, the process looks like this:

Since around 2010, PRAs such as Fastmarkets MB, S&P Global Platts, and CRU have published alumina price indices intended to reflect the prevailing market rate for spot alumina. The most widely referenced benchmark is the Australian FOB alumina index, published daily by Fastmarkets and Platts. Many alumina sales agreements are priced using a formula that averages multiple PRAs’ index values.

Recent market behaviour also highlights another structural challenge in alumina pricing. Prices often track marginal production costs rather than broader financial market sentiment. With bauxite prices falling sharply in 2025 and supply relatively flexible compared with many base metals, alumina prices adjusted downward even as parts of the non-ferrous complex remained firm. This cost-driven pricing dynamic is economically rational, but in an opaque, illiquid market, it can complicate benchmark formation, as price movements may reflect operational cost shifts rather than widely observable market trading activity.

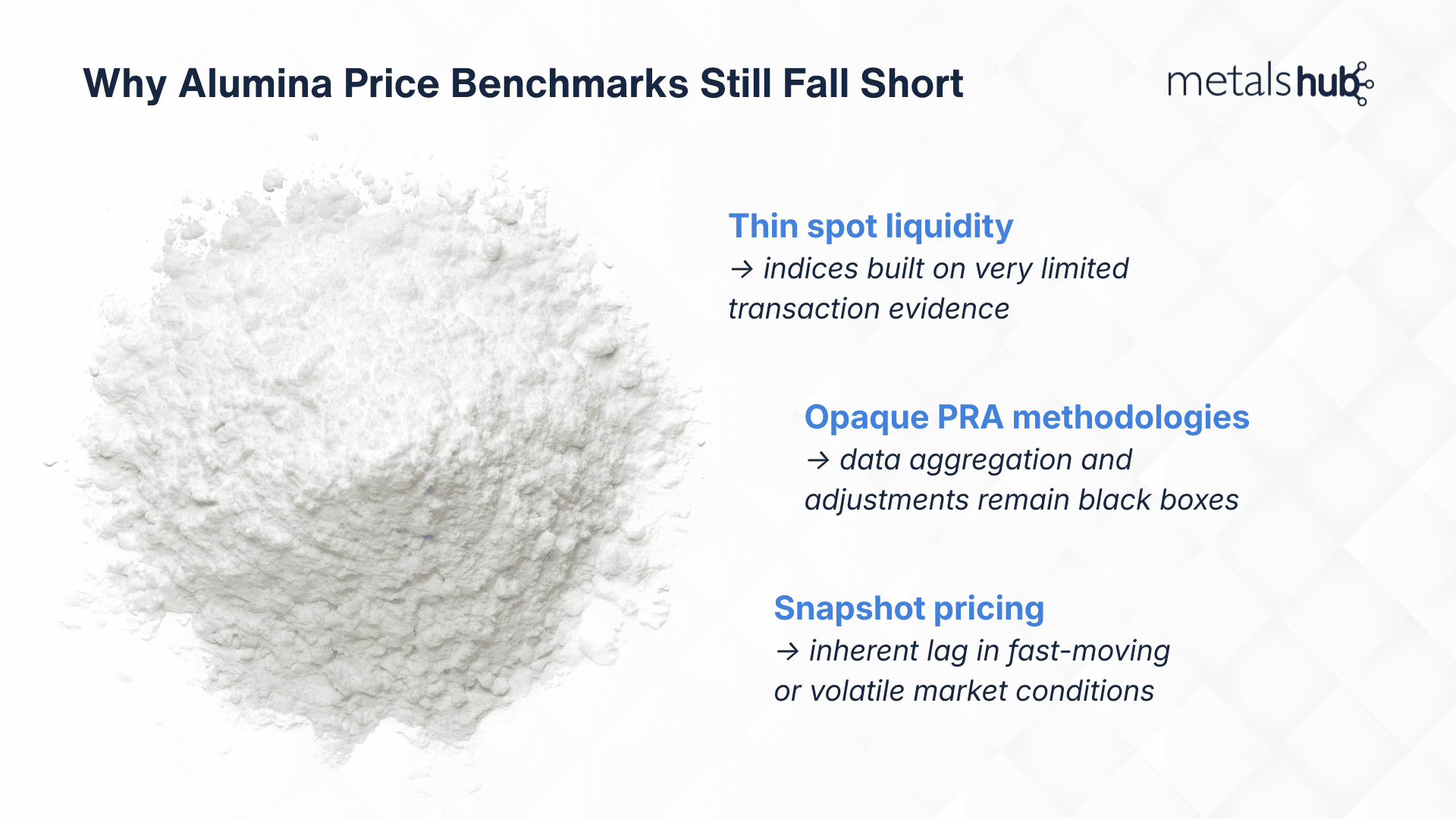

For procurement teams, traders, and producers, unreliable benchmarks translate directly into margin uncertainty, hedging inefficiencies, and negotiation friction. It is clear that journalistic PRA indices have inherent limitations given the market’s thin liquidity.

When trades are few, even a transactions-only index can struggle. CRU’s index may hold steady at the last done deal until a new transaction occurs, making prices appear stale or suddenly jumpy. Survey-based indices, on the other hand, may interpolate or extrapolate from sparse data, introducing subjectivity.

The problem is compounded by structural demand rigidity. Around 95% of alumina consumption feeds primary aluminium production, where capacity expansion is often constrained by policy, energy availability, or environmental regulation. This means price discovery tends to react more to supply shifts than to balanced two-sided market trading. Greater transparency, including transaction data from digital trading platforms, can strengthen confidence that published prices reflect real market activity rather than assumptions or limited survey inputs.

In low-liquidity, high-volatility conditions, market participants often question whether any index is capturing “real” value. During chaotic periods, different PRAs have produced diverging assessments.

Because indices are built by humans following defined methodologies, mistakes can happen. In August 2025, Fastmarkets issued a correction to its flagship FOB Australia alumina index after a back-end calculation error.

Similarly, in October 2025, a published price was first revised, then adjusted again days later after procedural lapses were identified. While Fastmarkets handled the issue transparently and updated its database within 24 hours, industry observers noted that confidence in the indices is only as strong as the rigour of the methodology and the data inputs.

PRA indices offer periodic snapshots of the market rather than a continuous price stream. In fast-moving conditions, published benchmarks inevitably reflect transactions that have already occurred, so some degree of lag is inherent to any index built on real deals.

This dynamic was visible in September 2018, when the Australian alumina index peaked at $652.92 on September 17 before falling 28% to $468.40 by October 1 as lower-priced cargoes entered the market. Such adjustments often appear first in upstream inputs like bauxite, where procurement behaviour responds quickly to refinery margin pressure before alumina benchmarks fully adjust.

Aluminium pricing benefits from a deep, liquid global market anchored by the LME. For decades, alumina was simply priced as a fixed percentage of the LME aluminium price. This percentage-of-LME model (typically around 11–14% of aluminium’s price) was used because alumina itself wasn’t openly traded in large volumes.

The percentage-of-LME model was convenient for smelters, but it ignored alumina’s own fundamentals, even though the drivers of alumina refining (bauxite availability, energy prices, caustic soda, logistics) are very different from those of aluminium smelting.

By 2010, Alcoa began pushing to decouple alumina pricing from aluminium. Alcoa’s leadership publicly described the old system as “very unusual,” arguing that tying alumina to aluminium masked real cost pressures and distorted market signals. Other major producers, including BHP, supported the move toward index-based pricing. Alumina was effectively declared its own market rather than a derivative of aluminium.

Once unpegged, alumina prices began moving independently, and sometimes violently. In 2018, supply disruptions, most notably at the Alunorte refinery, sent spot alumina prices above $700 per tonne. At the same time, aluminium prices on the LME remained relatively stable around $2,000 per tonne. In the same year, US sanctions on Rusal acted as a catalyst for the shift to independent alumina pricing. By abruptly disrupting alumina flows and tightening spot supply, they pushed prices sharply higher while the LME aluminium price remained comparatively stable. This exposed the weakness of percentage-of-LME formulas and accelerated the move toward index-based pricing, reinforcing alumina as a standalone market.

For smelters, the impact was severe. Alumina, which is often considered manageable below roughly 19% of the aluminium price, suddenly consumed far more of the margin. Some smelters were paying $600 per tonne for alumina while selling aluminium at $2,000 per tonne. As one trader said: “You can no longer look at the LME aluminium price for alumina. It is its own market, and the disconnect… made some people lose a lot of money”.

Regional price differentials (premiums/discounts) are a structural feature of the alumina market. The Australian FOB index is widely used as a base price, but actual transaction prices often include a regional basis adjustment.

For example, an alumina cargo delivered from the Atlantic region (e.g., from Brazil) incurs lower freight costs to many smelters in the world, so it might consistently trade at a premium to the Pacific basin price.

Buyers and sellers must manage basis risk between the index and their actual price. A European smelter signing a contract at “Australian index + freight + premium” still faces uncertainty on that premium portion, which is negotiated and cannot be hedged. If freight rates spike or regional supply shifts, their delivered price changes even if the base index does not.

Recent developments in China underline this risk. Recent data from Mysteel show alumina inventories hitting record highs in early 2026 after seven consecutive months of stock builds, pushing domestic spot prices lower despite relatively stable, ex-China benchmarks.

China’s weekly alumina inventories rebounded sharply in 2025 after a prolonged decline. Credit: AL Circle

Supply chain dynamics can also influence price signals. In late 2025, oversupply pressures intensified as some aluminium smelters delayed long-term contracting while alumina refiners maintained output following profitable earlier quarters. This temporary imbalance pushed spot prices lower, illustrating how procurement behaviour can shape benchmark formation in a relatively thin market without necessarily reflecting longer-term fundamentals.

There have been repeated attempts to create a centralised, exchange-traded alumina price, but none have gained lasting traction. Both the LME and the CME have launched alumina futures contracts. They were intended to provide transparent price discovery and a hedging tool similar to aluminium.

Despite initial interest, liquidity never reached critical mass. Without a trusted price benchmark backed by sufficient physical volume, any exchange-based futures contract struggles to get traction.

The current system for alumina price discovery (private contracts and journalistic PRA indices) often leaves market participants questioning if the reported price truly reflects real deals. A credible benchmark should ideally be grounded in real transactions (“traded prices”) and be difficult to manipulate or distort.

Both sides of the market feel this gap. Consumers want to ensure they’re paying a fair price, while producers want confidence that indices will reflect any genuine tightness.

Transaction-based pricing doesn’t necessarily mean everything must trade on an exchange. It can also be achieved via digital market platforms where buyers and sellers negotiate and execute deals, with the platform aggregating that data into a reference price.

Regulatory and financial pressures are making transparency more important. Initiatives like carbon border adjustments (CBAM in Europe) and sustainability requirements mean companies need clearer cost baselines and audit trails for materials like alumina.

Looking ahead, price discovery may become even more sensitive to spot liquidity. If indexed long-term contracts continue to grow as a portion of the entire market, marginal spot transactions will carry an even greater weight in determining index values. This could increase price responsiveness but also volatility, reinforcing the need for transparent transactional data rather than survey-based estimates alone.

Digital platforms connect buyers and sellers directly, enabling more efficient transactions and real-time visibility of market prices. In the context of alumina, a digital trading platform can serve as a central hub for spot deals.

Comparable examples exist in other commodity markets. Platforms such as Comdaq in the PGM sector combine digital spot trading with price publication, illustrating how transaction-based marketplaces can contribute to price formation while increasing transparency in otherwise opaque physical markets.

Metalshub provides a digital marketplace that captures price discovery through real transaction activity between verified buyers and sellers. The platform digitises the full commercial terms of each offer and enquiry, including:

The platform increases visibility into regional pricing dynamics by showing how freight costs, local supply-demand balances, and specification differences impact final transaction prices. Procurement teams can compare offers on equivalent terms and quantify regional variations. Also, suppliers can compare the netback across multiple selling opportunities.

As transaction volume grows, the commercial signals strengthen, producing a more accurate view of price formation than bilateral negotiations or journalistic assessments. Metalshub does not replace existing benchmarks but enriches them with comprehensive data from legally binding bids, offers and transactions. Book a demo to see how real transaction data can strengthen your pricing decisions.

Price discovery in Metalshub

Newsletter

insights