Metalshub as the only source

Data Source

The price data is solely based on real transactions, bids and offers from the digital Metalshub platform. The information is collected automatically without any journalistic work or telephone calls to market participants.

This methodology minimises the risk of price manipulation and ensures a more robust picture of real market prices.

Automated data cleaning

Data Normalisation

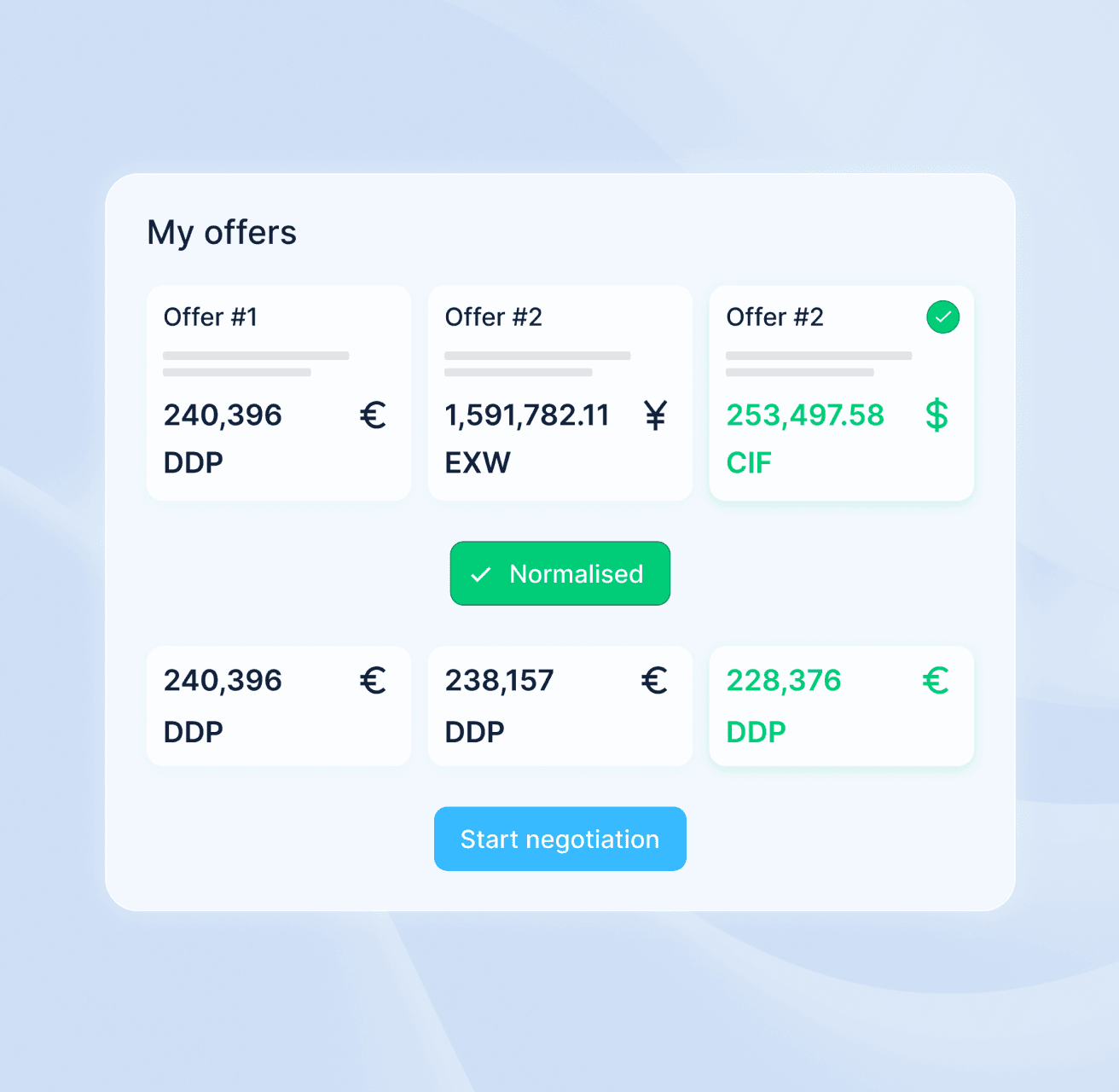

The raw data generated on the platform include all parameters of the transaction/negotiation, including the quantity, full chemical specification, payment terms, packaging and transportation cost.

This enables Metalshub to normalise each data point correctly and to exclude data points, which do not meet the specifications for each price index. The process of evaluation and selection of data is based on an algorithm. Consequently, the risk of error caused by human interaction is minimised.

Completely anonymised and untraceable

Data Security

The confidentiality of Metalshub users’ price data is of utmost importance to us. We will never share individual data points and even employees of Metalshub only have restricted access to raw data. It will never be possible to traceback price indices to individual

transactions or negotiations.

Access to data on Metalshub is strictly limited to a minimal number of Metalshub employees. Therefore, the team has only access to anonymised transaction data from the Metalshub platform. Hence all information regarding individual negotiations remain confidential.

Price Data Methodology

Process DescriptionProcess Description

Price data points originate from negotiations on enquiries. An enquiry (Request for Quotation) can have several parties submitting a negotiation (quotation) on a listing. As the negotiating parties on Metalshub can update their quotations only the latest proposal is part of the evaluation process (i.e. the last offer by a seller on a “buy-enquiry” and the last bid by a buyer on a “sell-enquiry”).

The process of price data collection, evaluation and selection for the Metalshub Price Indices is fully automated.

Every Friday, the automated algorithm analyses the data from the past week and determines the index price for the week by following a series of predefined steps.

The data collected from trading activities on Metalshub include quantity, chemical specification, dimensions, packaging, storage and delivery locations, payment terms and price.

From all activities on Metalshub for the respective product the algorithm excludes data points which do not meet the index specifications (for example, FeSi 65% Si, 3-10mm).

The remaining price points have to fulfil the following requirements to find their way into the index:

- The data point may not be a trader to trader transaction (anonymous term sheet mode)

- A confirmed negotiation (transaction) will be considered (as long as point 3 is fulfilled).

- For enquiries without a confirmed transaction the two best negotiations will be considered (i.e. the two lowest offers on a buy enquiry, the two highest bids on a sell enquiry).

Metalshub guarantees that for the weekly price index at least five datapoints from independent companies for every particular product were considered. In case of a smaller number of datapoints or their absence during the reporting week, Metalshub continues the price trend of the previous week and makes a corresponding note on the platform near the product’s price index chart.

In order to have comparable data forming the index the price points are first normalised to cash payment terms and FCA a warehouse in a major European sea port. In order to normalise the price data relative to the payment terms, the interest rate of the respective central bank is used. For Europe, it is the base rate of the European central bank+3%. Actual transport rates are used to normalise price data in relation to logistics: E.g. from DDP/DAP based prices, shipping costs to the nearest major European seaport are deducted.

The considered and normalised data points will be weighted by Volume (transactions with volume exceeding 100 mt are considered as 100 mt), Transaction (100%) and negotiation (10%). Thus, the difference in prices for different batch volumes is taken into account.

The calculated price indices are immediately and automatically published on the Metalshub platform.

Ready for More Information?

Discover how Metalshub can streamline your procurement, sales, or tolling processes. Contact us and book your demo now for a firsthand look.