Copper

Copper Concentrate: Reshaping Price Discovery Through Digital Trading Platforms

Published on

Share Post

Copper

Written bySamir Jaber

Published on

Share Post

Index

The copper concentrate market is in a period of pronounced imbalance. Smelting capacity has outgrown mine supply, and 2025 commercial talks have exposed the strain on a decades-old pricing system. Bilateral deals increasingly struggle to reflect real-time market conditions, with both miners and smelters questioning the relevance of fixed annual references. The high-profile dispute between Teck Resources and Sumitomo Metal Mining over concentrate sales terms has brought long-standing concerns about the benchmark TC/RC mechanism to the surface, showing how disconnected it has become from spot-market reality.

At the same time, Teck’s announced merger with Anglo American marks a pivotal moment of consolidation in the copper industry. The planned combination would create one of the world’s largest diversified copper producers, capable of leveraging procurement scale, shared logistics, and digital trading infrastructure to improve liquidity and pricing flexibility. Together, these developments illustrate a market in transition, where legacy conventions are under review, and the shift toward more transparent, data-driven price discovery is accelerating.

The breakdown of the benchmark system is also changing how counterparties engage. As annual contracts lose relevance, producers and smelters are turning to digital bidding and spot-market mechanisms to establish fair value in real time. BHP, the largest copper producer in the world, has highlighted how digital ecosystems can integrate value chains around a single source of verified data. This evolution mirrors what has already occurred in iron ore and coal, where transparent, transaction-based mechanisms replaced opaque benchmarks. For copper concentrates, it signals the beginning of a structural shift toward modern, platform-driven price discovery and verifiable digital negotiation.

Adapted from: The Oregon Group

The copper concentrate market’s imbalance has been years in the making. Mine development has slowed sharply amid rising capital costs, lengthy permitting, and heightened geopolitical risk. Meanwhile, global smelting capacity, driven by China’s continued expansion and debottlenecking, has outgrown mine supply. The result is a market where concentrate feedstock cannot meet the processing capacity built to consume it.

The pressure is visible in treatment and refining charges (TC/RC). The 2025 benchmark of US$21.25 per tonne and 2.125 cents per pound has become largely symbolic. Spot terms in Asia have fallen to zero or even negative values, meaning smelters no longer receive the usual discount for processing concentrate. While they continue to generate income through by-products such as sulphuric acid and higher recoveries of copper, gold, and silver, these offsets are insufficient to restore margins under current market conditions. This inversion of long-standing commercial norms has widened the divide between large, state-backed Chinese operators, which can sustain record utilisation, and smaller, independent smelters elsewhere struggling to cover costs or are temporarily shutting down.

The market’s pricing structure compounds the problem. The long-standing benchmark system, negotiated annually by a handful of producers and smelters, lags real market conditions and fuels disputes when spot tightness diverges sharply from agreed references. With mine disruptions continuing in Chile, Peru, and the Democratic Republic of Congo, and project lead times exceeding a decade, analysts expect concentrate tightness to persist at least through 2027.

These constraints have exposed the limits of opaque negotiations and static benchmarks in a market increasingly shaped by real-time supply shifts. Transparent, data-driven price discovery is becoming essential to balance bargaining power, keep terms closer to the market price, and restore confidence in how pricing is set.

While pricing mechanisms struggle to adjust, major producers are reinforcing long-term supply resilience. BHP’s A$840 million investment at Olympic Dam, focused on improving smelter efficiency and throughput, reflects a sector adapting operationally even as commercial conventions lag behind.

The challenge is bridging the gap between today’s constrained reality and the investments required to meet tomorrow’s electrification demand.

Adapted from: Bloomberg

The imbalance in copper concentrates is redrawing traditional power lines across the supply chain.

The deeper one moves into the value chain, the more fragile sentiment becomes. Yet in the concentrate trade, the pivotal tension remains between mine feed and smelter appetite, and how digital platforms can bring transparency to the terms that bridge that gap.

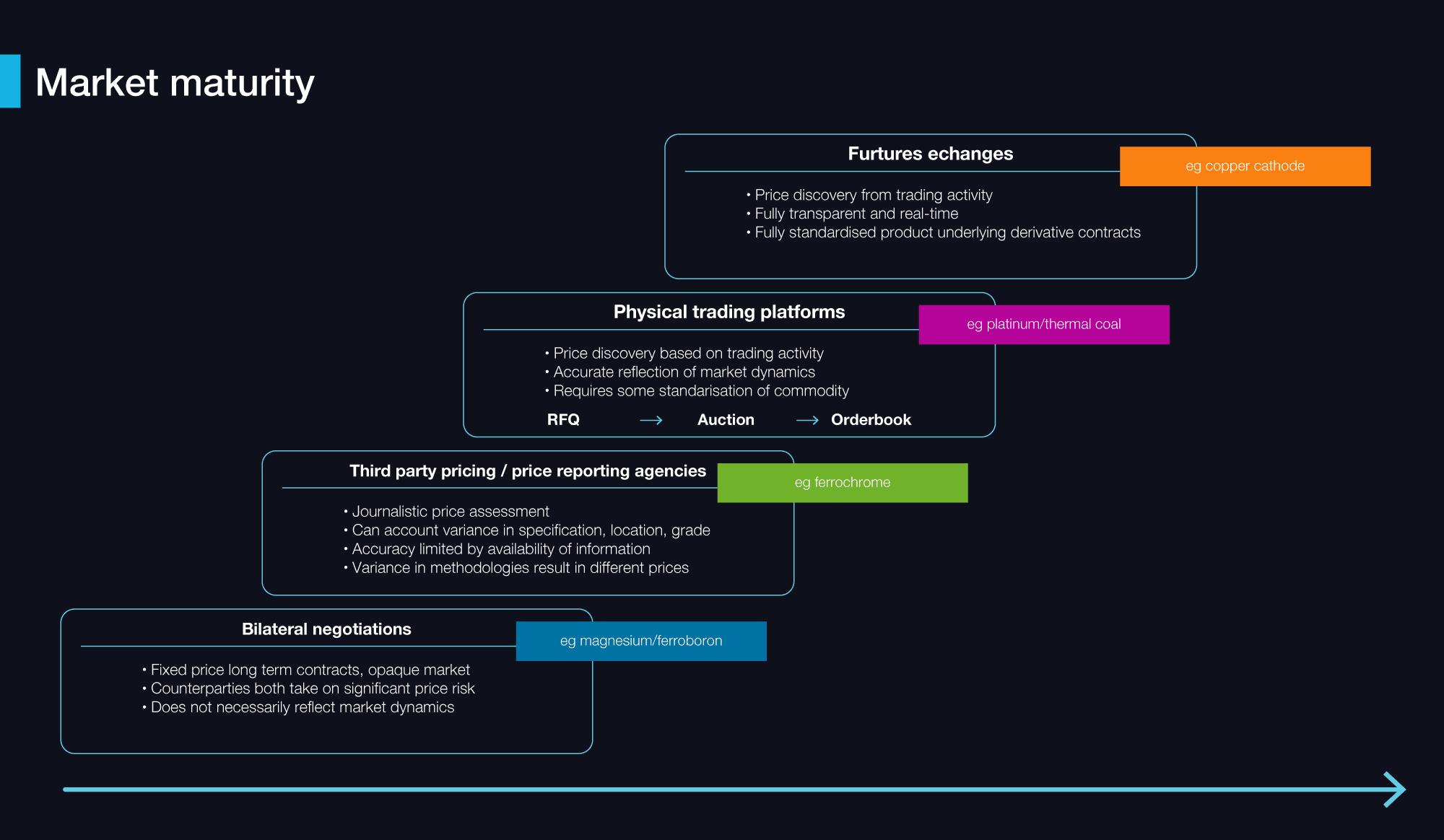

Digital bidding events are emerging as the next step in how copper concentrate could be priced, negotiated, and reported. While this model is already established in other bulk commodities such as coal, iron ore, and lithium, its relevance to copper concentrates is becoming increasingly clear.

Rather than relying on static annual benchmarks, digital bidding introduces a repeatable, data-driven process that reflects actual market conditions at the time of trade and creates the transparency needed for credible price discovery.

Producers and smelters define event parameters on the Metalshub platform, such as product specifications, commercial terms, quotational period, penalties, delivery terms, and payment conditions. Verified counterparties are invited to bid within a set timeframe. Every bid, counterbid, and acceptance is logged, ensuring full visibility and a legally binding contract.

As the London Metal Exchange explains in its Price Discovery Demystified guide, physical trading platforms provide “binding bids and executed trades” that can evolve into reliable spot reference prices when supported by sufficient volume and standardisation. This principle underpins the LME–Metalshub collaboration, which applies these methods to physical raw materials where exchange-traded data is limited.

For copper concentrates, this model transforms how market value is established. Digital bidding events capture real transaction data, creating the transparency, repeatability, and confidence that traditional benchmarks no longer provide.

“The copper concentrate market shows what happens when spot market terms drift too far from annual benchmark prices. Physical trading platforms can help build liquid spot markets and establish a more robust pricing system for miners and smelters, as seen in commodities like iron ore, coal and lithium.”

The Metalshub platform enables true price discovery, standardisation, and compliance for the copper concentrate market.

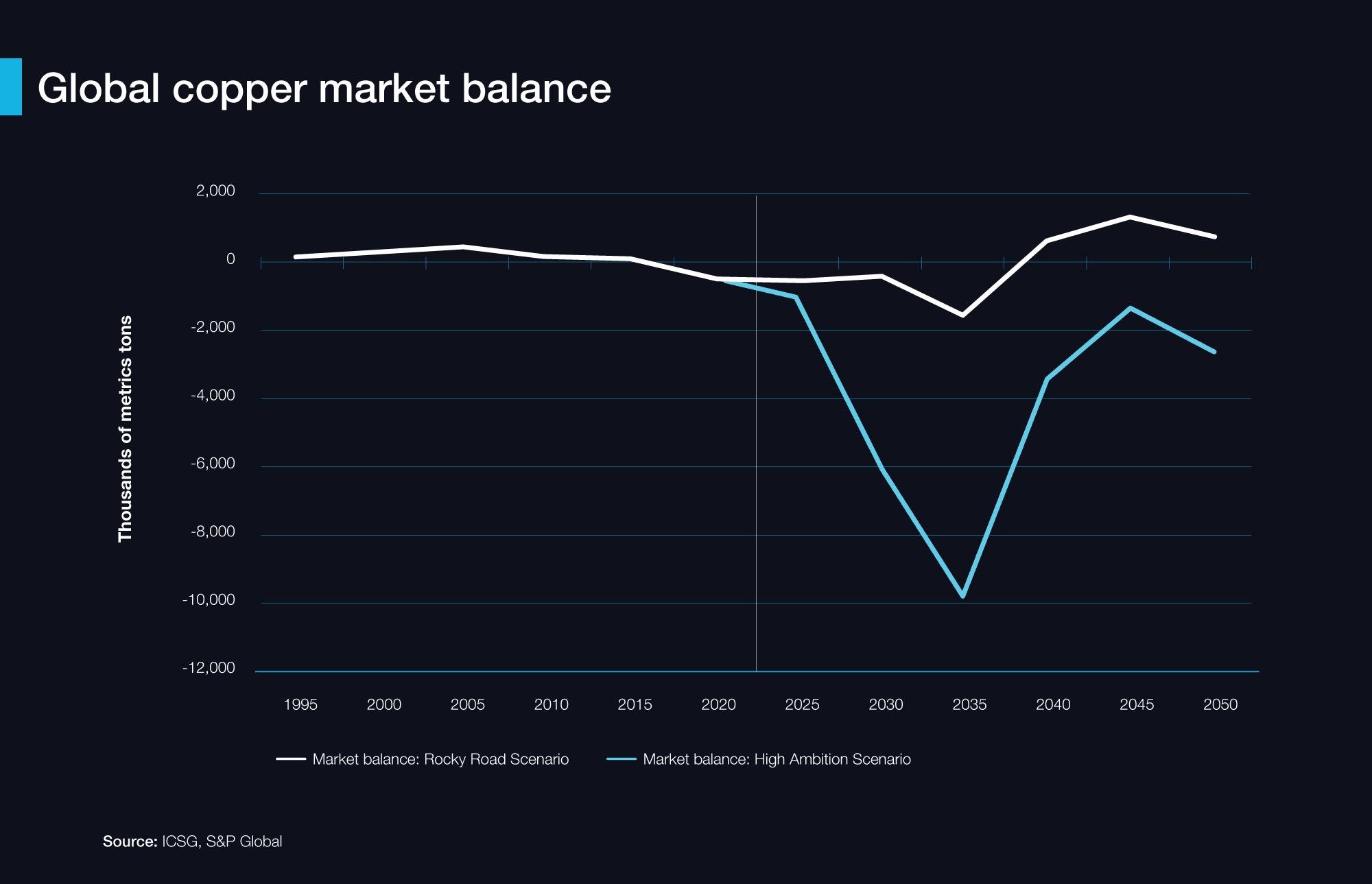

Looking ahead, copper’s long-term fundamentals remain strong, driven by electrification, renewable infrastructure, and data-centre expansion. But supply will remain constrained. Mine investment continues to lag, concentrate quality is declining, and geopolitical frictions are redrawing trade routes. Bloomberg analysts expect limited relief before 2027.

These conditions point to a more fragmented and data-dependent market, where participants will increasingly rely on verifiable, transaction-based signals to price and plan. Markets evolve through maturity stages, from bilateral deals to price reporting, digital tender platforms, and finally, exchange-based reference pricing. Copper concentrates are now firmly entering the third stage.

Adapted from: LME

Metalshub is already enabling this transition. By capturing binding bids and executed trades, the platform generates transparent market data and streamlines procurement operations, from ERP integration to ESG documentation and compliance reporting automation.

Digitalisation, therefore, is not an optional modernisation but a structural necessity for ensuring continuity, compliance, and competitiveness in the copper concentrate trade.

To learn more about how digital bidding events and structured sourcing can bring transparency and efficiency to copper procurement, visit Metalshub’s Copper page or contact our team for a detailed walkthrough.

Newsletter

insights